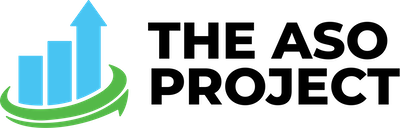

Apple recently announced tax and pricing updates that affect apps and in-app purchases in several countries. These changes may impact developer proceeds, making it important to understand what’s changing, which markets are affected, and how to adjust.

What’s New

The updates apply to Brazil, Canada, Estonia, Romania, the Philippines, and Vietnam. Apple has adjusted the portion of revenue developers receive after taxes and its commission.

Effective August 21:

-

Brazil: 3.5% IOF applied

-

Canada: DST no longer applies

-

Estonia: VAT increased from 22% → 24%

-

Romania: VAT increased from 19% → 21%; reduced VAT for news, books, and audiobooks 5% → 11%

-

Philippines: 12% VAT introduced for developers outside the country

-

Vietnam: New VAT and personal income tax rules; Apple commission remittance updated

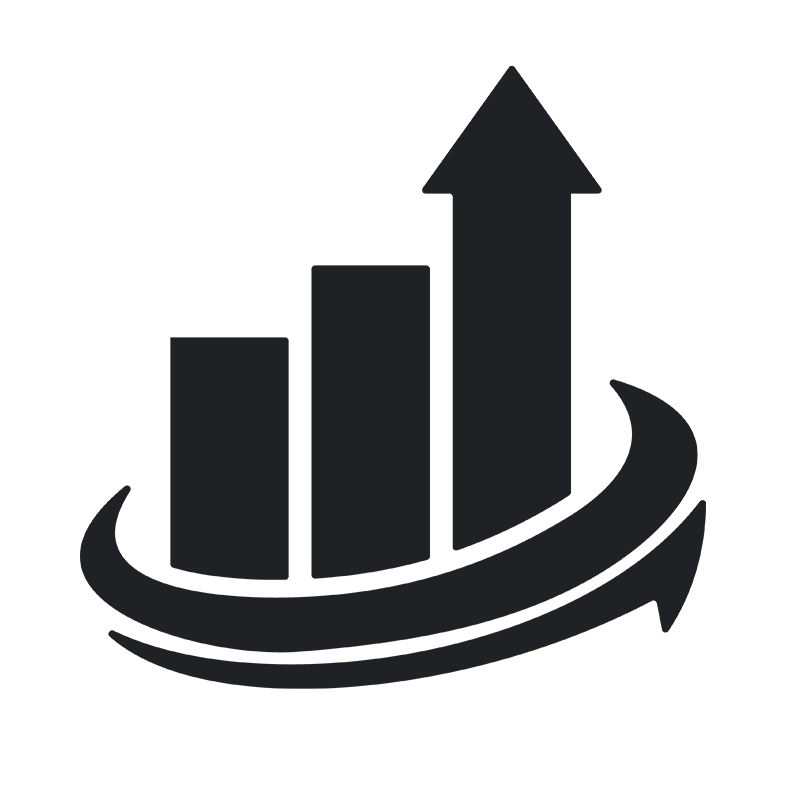

App Store Connect provides detailed information on updated pricing and tax adjustments, allowing developers to check how these changes influence revenue in each region.

Impact on Developer Proceeds and Monetization

These updates directly affect developer revenue, particularly for apps with significant user bases in the affected countries. Even small changes in tax or pricing can impact overall proceeds, subscription revenue, and monetization strategies. Reviewing these adjustments ensures pricing remains aligned with market expectations and helps developers maintain predictable revenue across regions.

Next Steps

Check App Store Connect for updated tax and pricing details to understand the impact on revenue. Updating app or in-app purchase prices where needed helps maintain predictable revenue and keep apps competitive across regions.